Understanding the Statutory Legacy for a surviving spouse under the Succession Act 2006 (NSW)

)

In cases where someone passes away without leaving a will, also known as dying intestate, in NSW the surviving spouse is entitled to what is referred to as a spousal legacy or more commonly known as the statutory legacy. This legacy is calculated and adjusted to reflect the cost of living over time. Section 106 of the Succession Act 2006 (NSW) outlines the rules and formulas for determining the statutory legacy due to the surviving spouse.

What is the Statutory Legacy?

A statutory legacy is a specific amount of money that the law entitles a surviving spouse to receive from the estate when their partner dies intestate. The primary goal of this provision is to ensure that the spouse receives adequate financial support. This legacy amount is adjusted for inflation using the Consumer Price Index (CPI), ensuring that the value of the legacy keeps pace with changes in the cost of living.

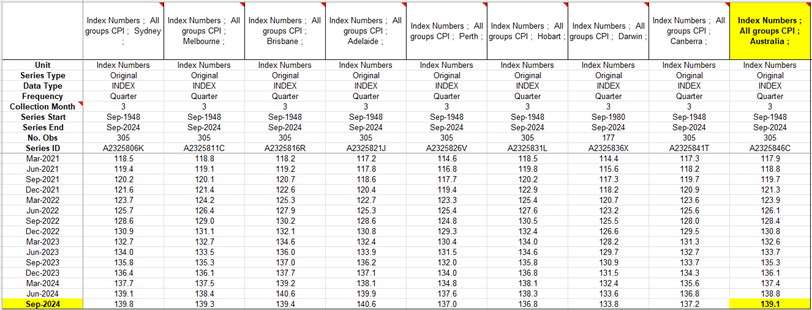

The Consumer Price Index (CPI) measures household inflation and includes statistics about price change for categories of household expenditure. CPI for a quarter means the ‘All Groups CPI’ published by the Australian Bureau of Statistics (ABS) in respect of that quarter, being the weighted average CPI of the 8 capital cities.

Where to Find the CPI Number

The CPI number can be found on the ABS website through the following link: https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/latest-release. For the convenience of our readers, we have included the table of All Groups CPI data from March 2021 to September 2024.

How is the Statutory Legacy Calculated?

Section 106 of the Succession Act 2006 (NSW) specifies a formula to calculate the statutory legacy as per below:

R = A x (C÷D)

Where:

- R is the CPI-adjusted statutory legacy.

- A is the base amount of $350,000.

- C represents the CPI for the last quarter published before the date of the intestate's death.

- D is the CPI for the December quarter 2005, being 83.8 (Note: This figure is a result of re-referencing by the ABS based on a historical CPI figure of 150.6)

Example Calculation:

To understand this better, let us take an example.

If a person died on 3 November 2024, then the CPI relevant for the calculation would be the number last published before 3 November 2024 and the CPI number for the September quarter of 2024 was 139.1, as published on 30 October 2024.

Therefore, the statutory legacy can be calculated as follows:

R= $350,000 x (139.1 ÷ 83.8)

This results in:

R=580,966.587

Thus, the CPI-adjusted statutory legacy payable to a spouse would be $580,966.59.

As the CPI for September quarter 2024 is the latest CPI number, the CPI-adjusted statutory legacy is $580,966.59 (as of 15th November 2024).

Interest on Unpaid Legacy

Section 106 of the Succession Act 2006 (NSW) also provides that if the statutory legacy is not paid, or not fully paid, within one year of the intestate’s death, the surviving spouse is entitled to interest on the legacy. This interest applies to the outstanding amount from the first anniversary of the death until the legacy is paid in full.

If you have any questions concerning statutory legacy or intestacy, contact us for a free thirty-minute consultation with our estate law team.

Any information on this website is general in nature and should not be taken as personal legal advice. We recommend that you speak to a lawyer about your personal circumstances.

Photo by KATRIN BOLOVTSOVA:

| Tags:Legal PracticeStatutory Legacy |